Forums › Strategies and Expert Advisors › Price Action Engulfing Candles EA › Description of Price Action Engulfing Candles Strategy › Reply To: Description of Price Action Engulfing Candles Strategy

Hi folks!

I’ll start today again from theory, but soon we get to practice  Before we go to opening, modifying and closing orders, setting TPs and SLs, I want to describe you first the rest of the parameters.

Before we go to opening, modifying and closing orders, setting TPs and SLs, I want to describe you first the rest of the parameters.

So, to secure improper enters system, among others, uses two indicators. One of them is Average Directional Index, which provides information about strength of trend and second, Relative Strength Index – about direction of trend. In both cases, for testing purposes, we can use standard (most popular) periods, so I recommend 14 for ADX and 7 or 14 for RSI. Now, the most important issue here are levels of ADX and RSI. In both cases (ADX and RSI), we set only one level. For ADX it’s high level, above which system doesn’t open orders. And for RSI it’s low level below which system only opens BUY orders. High level for RSI is set automatically and it’s symmetrical to low level (high level=100-low level). System opens SELL orders only if value of RSI is above high level. I think it’s clear and obvious. If you don’t want to use these two indicators RSI and ADX as filters, simply set the RSI low level to 100 and ADX high level also to 100. I tested for this system also filtering low values of ADX, but it didn’t show any positive results, so I hid this option in the parameters. I tested also many other indicators and combination of indicators, but until now I haven’t found nothing interesting what is worth to use with this strategy. If you have some ideas please let me know and we will talk about it.

Next filters (at the end on parameter list) refer to the trading hours for each day and trading days. I used this filter, because depending on the currency pair, we can multiply profits by turning off opening orders by system on Mondays and Fridays (or just Mondays or Fridays). Interesting, isn’t it? This is due to the different behavior of the market for a given currency pairs just after the weekend (the market needs to stabilize) and before the weekend (market calms down, many large orders are closed etc). If we want to trade also on Mondays and/or Fridays it would be that we lose more than we gain, because of the “fake” market behavior, false retracements, reversals, breakouts, etc. And similar situation may happen, for example, after the close of New York, and before London opening. Each period of time for each trading session is unique. As a curiosity, I suggest you to search and read about trading strategy called London Open Breakout. I also have one strategy and theory about it, but there’s no time for that now and in this topic.

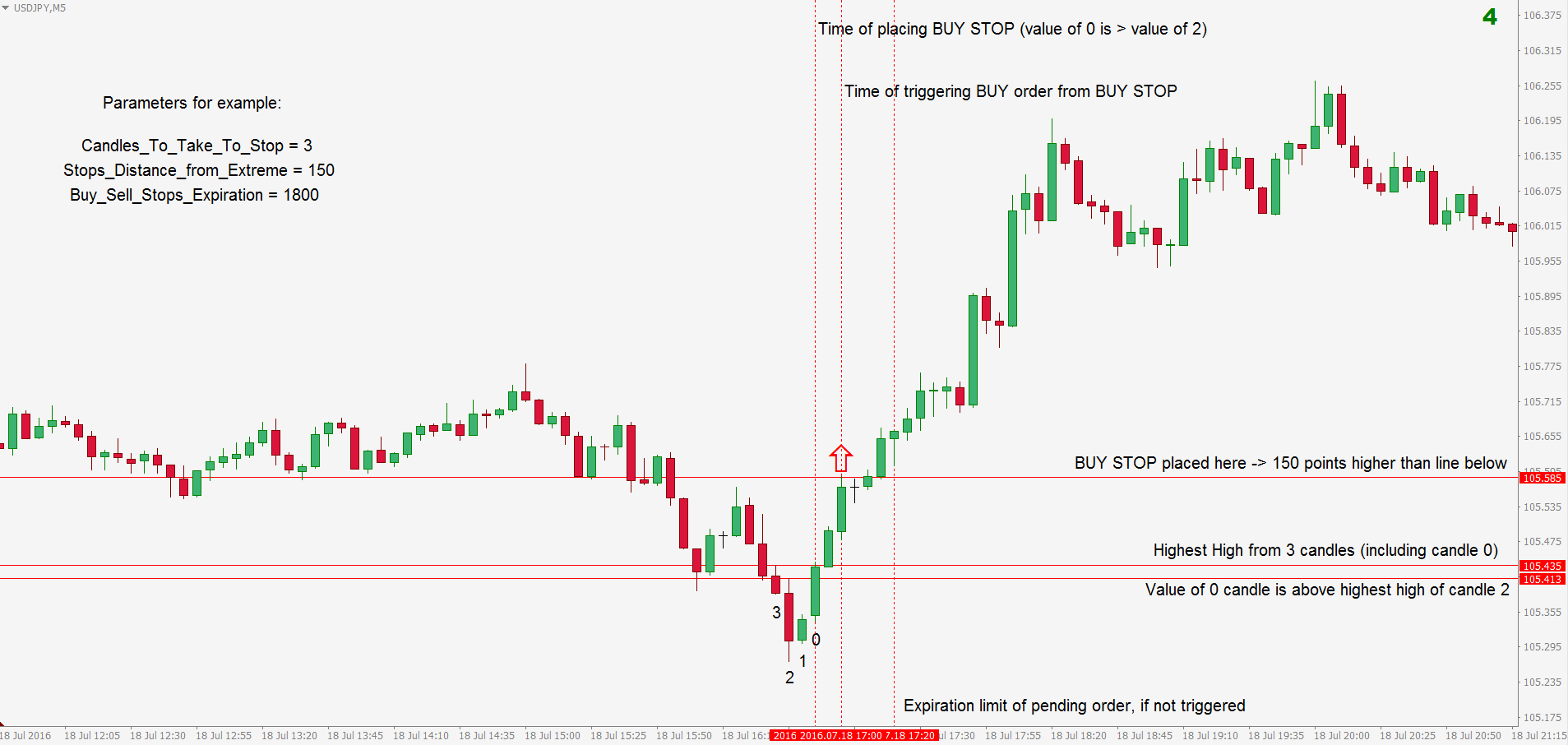

Ok, let’s go further. I’ve decided some time ago to change algorithm of opening orders in system. Previously system opened only market orders, which was executed immediately. I’ve changed that to pending orders, which gave surprisingly good results. Now, when every other conditions are met, system places BUY STOP or SELL STOP order specified value of points (point = pip/10) above highest high or below lowest low of specified number of candles back. There are two parameters which define that. First is “Candles_To_Take_To_Stop”, which defines from how many candles take highest high (for BUY STOPs) or lowest low (for SELL STOPs). Second parameter is “Stops_Distance_from_Extreme”, which defines how many points higher than highest high (BUY STOPs) or how many points lower than lowest low (SELL STOPs) will be placed pending order. Both of these parameters are very closely dependent on the characteristic and behavior of the specified currency pair. If we want to make it work perfectly, it must be very well optimized. And before I’ll show you example on screenshot I want to write about one more parameter, which is “Buy_Sell_Stop_Expiration”. Just like the previous two parameters, this also must be optimized individually for a given currency pair and it defines after how many seconds the order expires. Please remember that if we’re using system on M5 timeframe each one candle = 300 seconds. And 12 candles = 1 hour = 3600 seconds. Let’s see example.

As you can see on screenshot, pending order BUY STOP was placed when the value of candle 0 has reached and exceeded highest value from candle number 1 and 2 (and about this I’ve already written in a previous post). BUY STOP was placed according to our parameters that we have set, so specified value above highest high taken from specified amount of candles. I will explain it in more detail: order has changed from pending BUY STOP to market BUY order in that place where you see red arrow. The green candle below red arrow triggered BUY STOP order, because its value was higher than “Stops_Distance_from_Extreme” (150 points) from highest value of “Candles_To_Take_To_Stop” (3 candles). Of course, expiration time wasn’t exceeded and pending order was still awaiting until the time when finally has been triggered… and in this simple way we have opened BUY order  What could happen next I will write in next part of description.

What could happen next I will write in next part of description.

Take care and have a nice Wednesday!