Hello there! If you want to trade and win, you should know at least:

- where to start and get valuable and authentic knowledge (which I couldn’t get myself for many years when I started to trade and I know how difficult it is at the beginning),

- how to recognize the real market situation and see what is behind specific price movements,

- how to create good effective strategy using appropriate indicators,

- how to choose a cheap, but regulated broker,

- how to choose reliable and fast, but affordable VPS (if you plan to use an EA or indicators sending alerts, notifications or e-mails).

In the few next steps I will try to bring you closer to the profitable trading.

Whether you go through all the steps and achieve success depends from now only on you.

1. Knowledge, knowledge, knowledge

“An investment in education always pays the highest returns.” – Benjamin Franklin

The most important factor determining whether you win or lose on the market is knowledge. In the overwhelming majority of cases, only the lack of it causes defeat. If you don’t have time to study or you lack self-denial – sooner or later it will turn against you. Get ready for this defeat or just give up your actions now if you don’t want to start by learning.

As you see above I recommend a few books written by Steve Nison, who is considered to be a father of candlestick charting. It’s a real thing that you can trust. No scam.

Alright, I understand that not everyone likes reading books 🙂 despite the fact that this is in my opinion the most reliable source of knowledge, for those extremely resistant to the written word I have a different suggestion. There is a lot of online video courses about forex trading. It is probably problematic to choose courses that will be reliable and the content presented will be authentic. But there’s a way to find out which courses are good and which ones are e.g. scams.

Maybe you’ve already heard of Udemy. It’s a place where you can find various courses on various topics in many different languages and at different levels. If you search for “forex” there, you will receive hundreds or thousands results. Then you can explore and preview all these courses, check their content and ratings. The courses are often evaluated by thousands or tens of thousands of students, so you can check whether they have been received positively or not and whether they work in practice or just in theory.

What’s really interesting is that over 1,000,000 (1 million!) are learning Forex on Udemy right now. So, this number means something already.

By the way, you can also learn MQL4 and MQL5 programming there to create your own forex indicators, Expert Advisors, scripts and other tools. It’s probably much easier than you think. Maybe just give it a try?

2. Strategy and tactics

“Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.” – Sun Tzu

Failure to comply with the rules set out in the strategy and with principles of money management always leads to a loss. It’s just a matter of time. You should always keep in mind that there are no accidental long-term gains on the market.

At this point, I would like you to be the most interested in candlestick patterns and delve into “Price Action” and “Naked Trading”. You just don’t have to learn about any indicators and other “wonderful” trading support solutions at this stage, because it would just stir your head now. The clearer your mind will be, the more you focus on what is really important and then your trading will be the most effective.

Referring to the first point called “knowledge”, I recommend some great books that opens up a whole new world for you and allows you to look at the chart in a completely different way. I know this from my own experience (but not only). Just check it out below.

If you feel confident enough in reading candlestick patterns, you can go straight to the next step.

As I already said, I know that not everyone likes reading books 🙂 So I can also recommend to watch videos about Forex strategies and systems. There are tons of Forex videos on YouTube for free, but try to choose only reliable ones. Sooner or later you will be able to determine very quickly what is just a scam and what is real.

Below is my last video presenting the strategy, which I built on my RSI Dashboard (for those interested it’s available here: https://www.mql5.com/en/market/product/13223). Enjoy watching!

3. Broker

“I do not regard a broker as a member of the human race.” – Honoré de Balzac

Another key factor in achieving success is choosing a forex broker. It is very important to choose a good broker due to many factors. First of all, it should be a broker providing access to the interbank exchange rate without any “modifications” in the rates offered. A broker operating in this way is called “No Dealing Desk” broker (NDD), and the execution of orders takes place as “Straight-Trough Processing” (STP), so it’s just market execution with real market conditions. Trading with such a broker assures that the broker has no conflict of interest with the trader and it guarantees that you always trade at real market prices and liquidity.

The opposite of the NDD broker is the “Market Maker” broker, which, being between the trader and the interbank market offers rates that do not necessarily match the rates of the interbank market. Instead of market executions “Market Maker” offers instant executions which often leads to some difficulties with placing trades by broker at large liquidity providers and generally it has almost only disadvantages in comparison to market executions. When a trader opens position, the “Market Maker” creates at the same time an opposite position to hedge it. There are also reqoutes when trading with “Market Maker” (which doesn’t happen at all with the NDD broker).

In the case of the NDD broker, the spreads are often at the levels of several points (1/10 pip if rates have 3 or 5 digits after the decimal point). Often it reaches even 0, especially in the case of EURUSD, USDJPY, GBPUSD, USDCHF and other major pairs. In return for the fact that the spread is so low, we have to pay the commission by opening positions, but it’s not so large, so all the transaction costs are much lower than in the case of the “Market Maker” broker, where the spread alone exceeds them.

For many years I’ve been looking for the best regulated and fair NDD (ECN / DMA / STP) broker. You can now ask what does “the best broker” mean. I will tell you. From my point of view “the best” means one that:

- is regulated, so my money is safe,

- doesn’t wide the spread just to earn money on me,

- has the lowest transaction costs, i.e. lowest commission and the lowest possible spread,

- doesn’t charge any fees for depositing into a trading account and withdrawing to a bank account or credit card,

- has fast-acting, communicative and reliable customer support,

- and finally, allows trading from 0.01 lot so you can test all possible strategies on a real account with real market conditions and without risking a lot (as it is in the case of brokers where the minimum order size is e.g. 0.10 lot).

What’s more, they offer a very interesting program for traders and investors called DarwinIA in which they allocate up to 6 million € monthly to 80 traders and then they pay 15% success fee on profits. All you have to do to participate as a trader is to sign up and trade on a live account. When your live Darwinex account accumulates a minimum track-record your “DARWIN” enters DarwinIA automatically. You can also participate as an investor. You can opt in for tapping investor capital and get paid 20% performance fees based on the profits of your investors. Sounds interesting? Check it out by yourself.

4. Virtual Private Server (VPS)

“Part of the inhumanity of the computer is that, once it is competently programmed and working smoothly, it is completely honest.” – Isaac Asimov

As you may already know, many traders use VPSes for trouble-free operation of their Expert Advisors or to receive alerts from indicators etc.

These servers are (or rather: should be) characterized by highest stability, 100% up-time while the market is open (5 days / week, 24h), full compatibility of the operating system with the transaction platform of the broker, free of updates interrupting trading terminal operations or breaking connectivity with broker server. They should also have the lowest possible latency to the broker server.

I have used dozens of different VPS providers and I will say you that quality costs its price.

There are many VPS offers starting at $2 or $3 a month, but can you trust them? Until you trade on a demo account and you do not invest real money – yes. However, if your approach is serious and you want to be professional, it makes no sense to buy a VPS service that will be even worse than your own computer at home, which can also work just like this VPS.

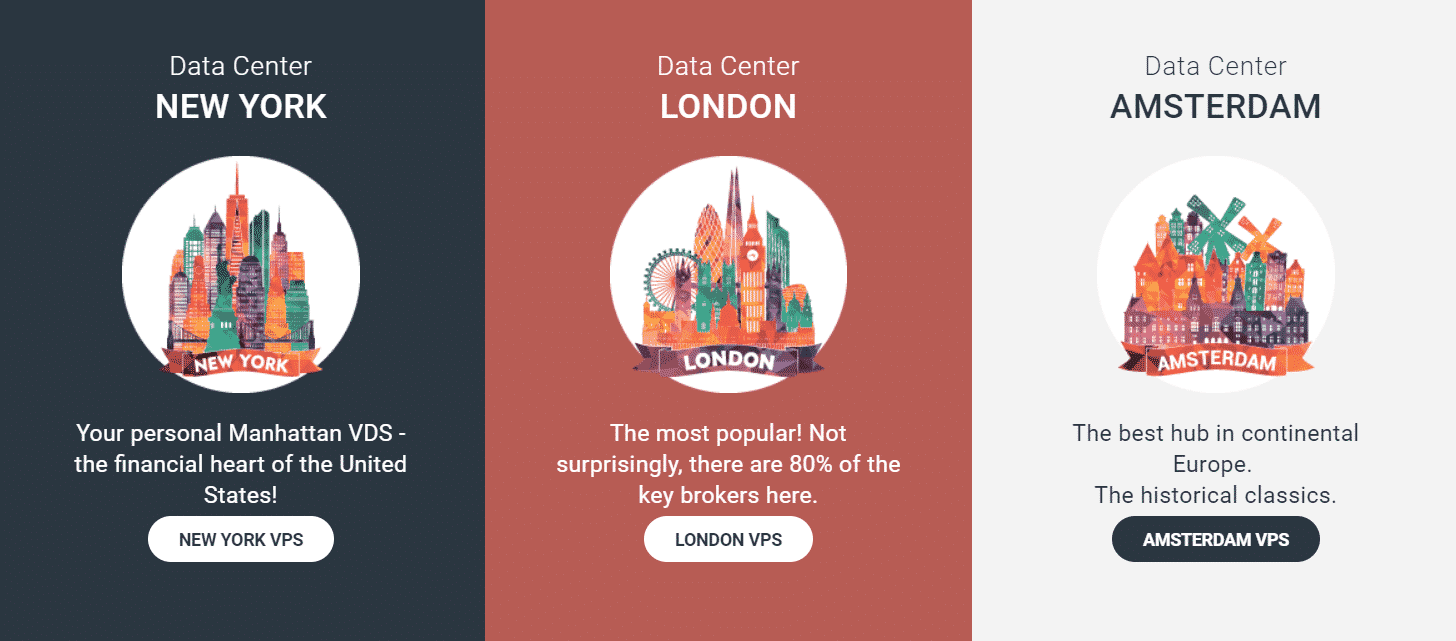

In addition to the stability and up-time of VPS, one of the most important factor is latency to the broker server. It’s nothing more than just the time after which we get answers to our queries (just like “ping”). The higher the delay, the worse the “quality” of rates offered by the broker. So, a you can guess, VPS should be in the same location as the broker server (e.g. London, New York, Amsterdam). This is important especially while using EA, because it can often open and close positions at outdated rates, which may be unfavorable and reduce profits or even cause losses.

For my own needs, I thoroughly tested many VPSes with many brokers and finally chose the best VPS provider whose offer is good for all type of traders, no matter if someone uses long-term strategy on higher timeframes and want to receive notifications or someone does scalping, high frequency trading or arbitrage. This provider is Chocoping.

Their data centers are located in three most important financial centers in the world:

- New York – almost behind the wall at Equinix, in close proximity to its NY8/NY9. Only a rare eminent broker do not have a server here.

- London, financial center of Europe – very close to Equinix LD4 / LD5. Almost every broker in the world has a server here.

- Amsterdam – popular hosting center in Europe when more than a half of the known dozen of brokers have their servers.

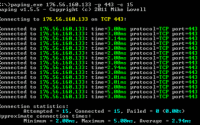

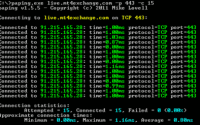

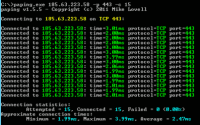

So that my tests are not wasted I will share them with you 🙂 From a server located in London, I tested ping directly from the MT4 platform to many different brokers having servers in London. In total, over 100 servers are listed below:

To make sure the tests are reliable and to check stability of latency which is unknown testing it through MT4, I also performed tests bypassing the MT4 terminal directly from the operating system (to the same ports as used by MT4, mainly 443). Unfortunately Windows can’t show results with more accuracy than 1ms if value is lower (it shows 0ms or 1ms if latency is below or approx. 1 ms), but anyway, as a stability test, the results are reliable. You can take a look below:

To sum up, in my opinion the choice of this VPS provider is the best value for money no matter what the needs of the trader are. I can honestly recommend their services. For those interested, I have 2 discount coupons that work on all their subscriptions:

- Coupon with 3% price cut that works with all monthly subscriptions: 80KUYG6G3V

- Coupon with 5% price cut that works with all annual subscriptions: 8GOOCEY811

You can use contact form below to write me about yourself and ask me all your questions.

I will try to answer to your message as soon as possible.